Business Checking

Tailored business checking

Optimized for startups

Banking services for pre-series

A companies to help jump-start your

business.

Free checking for your first three

years¹, up to 3.56% annual percentage

yield (APY)² on savings, and 2x

unlimited reward points³ on card

purchases.

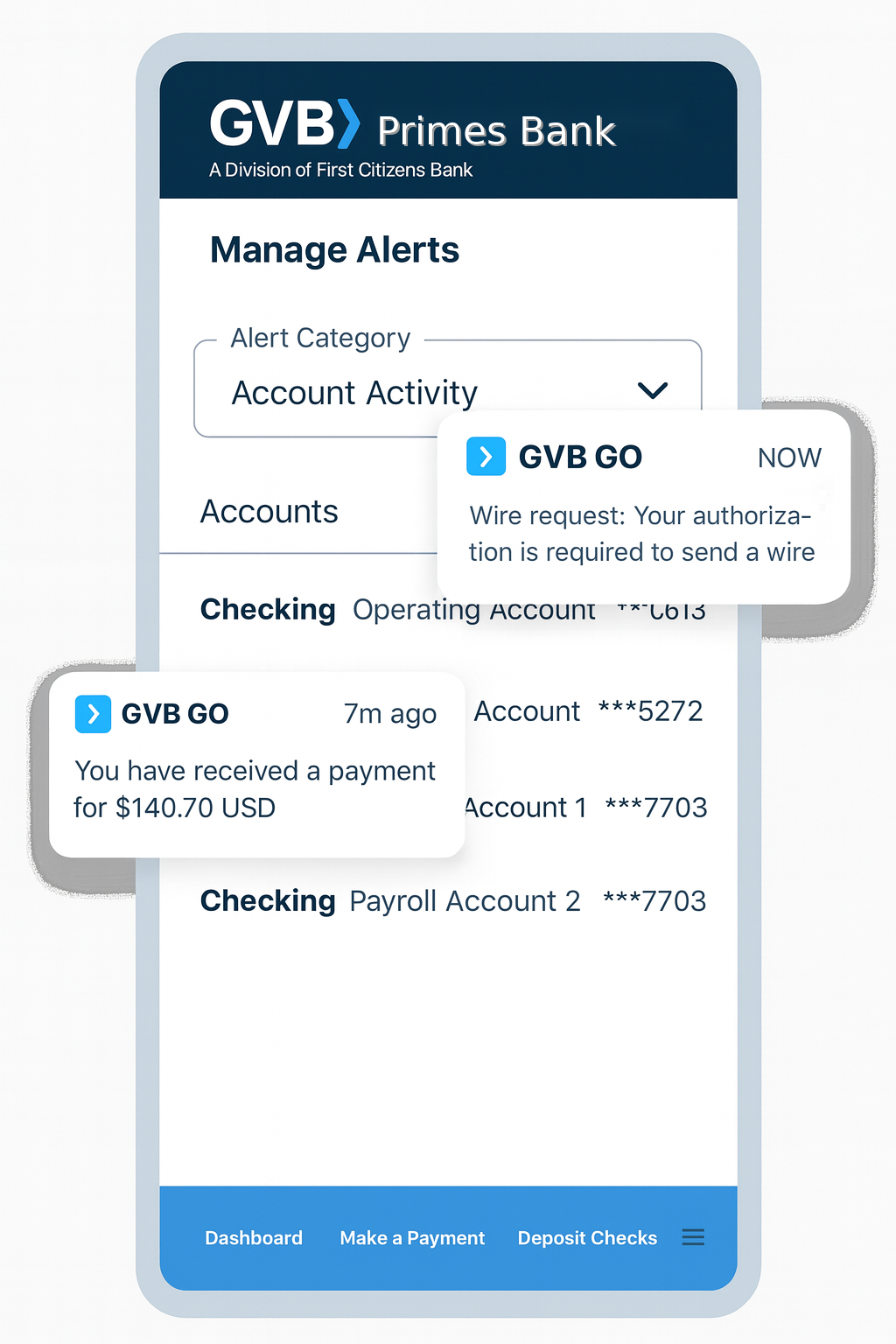

- A business checking account with no maintenance or transaction fees, free¹ online banking, unlimited incoming wires and ACH, unlimited outgoing wires including FX, bill payments and mobile deposits.

- Connections to Quickbooks, Xero, Expensify and other authorized applications.

- A startup money market account with up to 3.56% annual percentage yield on qualifying balances.2

- A business credit card with 2x unlimited points³, no annual fee and no foreign transaction fees.

Optimized for startups,

Series A and venture-funded

Banking services for growing companies with

an increased number of transactions.

Accelerate your business with up to a

$500 monthly credit that can be applied to

your service fees.4

- $50 monthly fee waived subject to qualification criteria.5

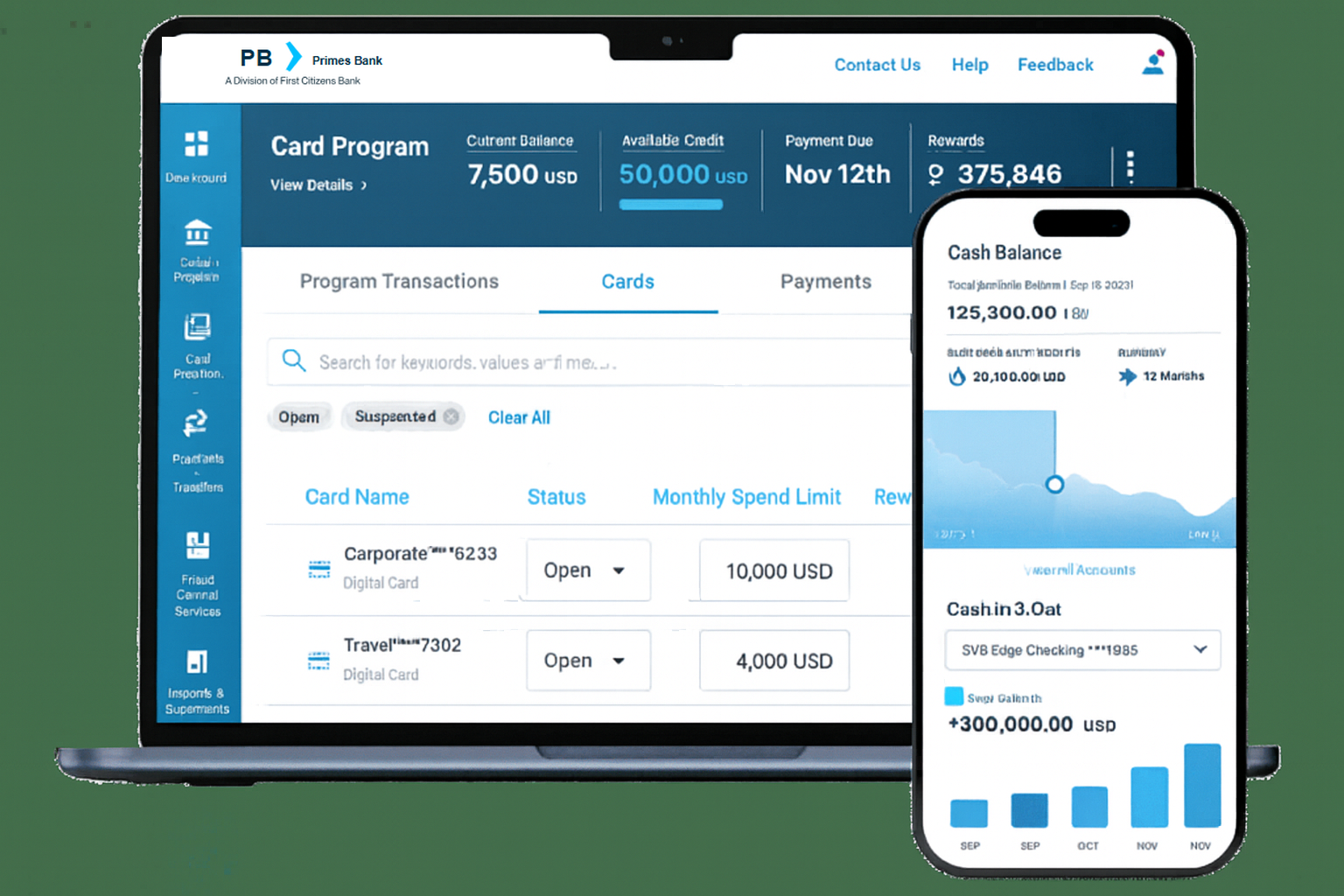

- Online banking including foreign exchange, customized reporting and connections to authorized accounting applications.

- Wires - incoming and outgoing (USD domestic and international, FX).

- Lockbox Services - including remote, wholesale and imaging.

- Payment automation through back-office accounting software or ERP.

- Remote Deposit Capture to scan and send electronic images of checks.

- Fraud Control Services including Positive Pay with Payee Validation and ACH Blocks/Filters.

Optimized for venture-funded and corporate banking

Banking services for scaling companies with

higher transaction volumes.

Service charges

can be offset with earnings credit (ECR)

based on your account balances.

- Access to full suite of cash management services for more complex banking needs.

- Receive earnings credit on balances that can offset most maintenance and service fees.

- Access cash management services to help you simplify accounting, lower business costs and better manage cash flows.

- Group accounts together to simplify cash management by combining earnings credit and eligible fees.

- Detailed monthly analysis statements let you easily monitor account activity.

Explore more ways GVB can help you

Ready to get started?

What’s included with our business checking solutions